(Registration No. 199301008024 (262761-A))

Kuala Lumpur, 20 January 2023

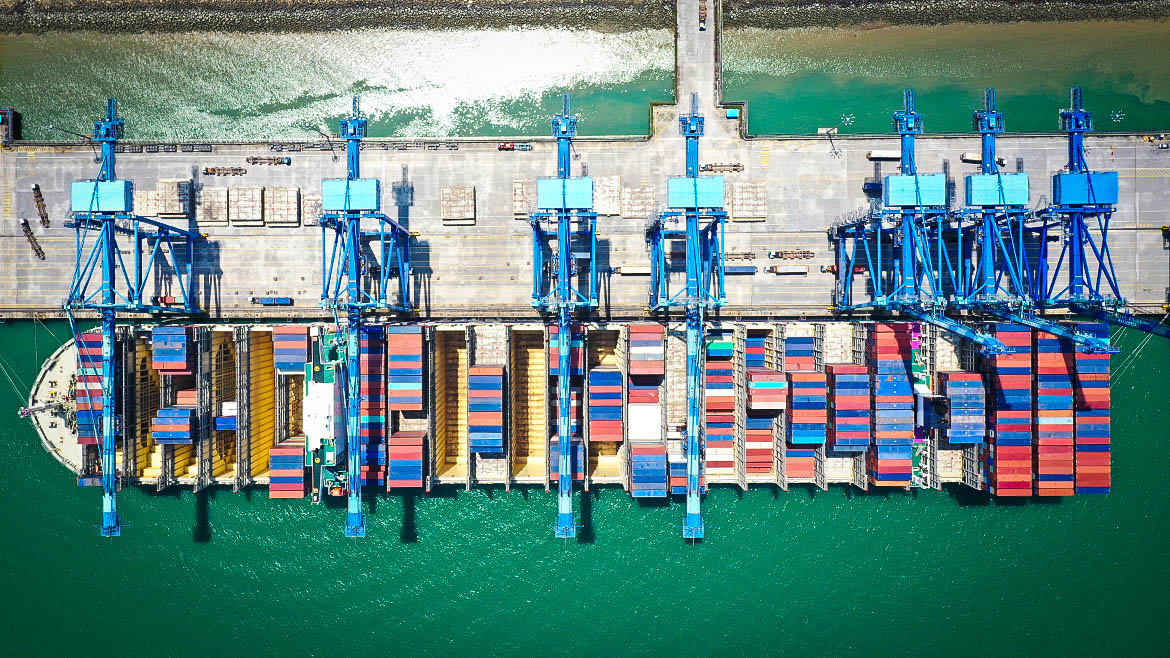

Westports Holdings Berhad (“Westports” or the “Company”) has announced its financial results for the 4th Quarter of 2022, and the 12-month ended on 31 December 2022. At the top line, the Company reported a total revenue achievement of RM2.07 billion in 2022. The container segment contributed 86% to total revenue by handling a throughput volume of 10.05 million TEUs.

The year under review witnessed multiple headwinds, some of which have shown signs of moderation as the year ended while others possibly contributing towards longer-term structural shifts. Global economies are adjusting to higher global energy prices while sourcing particular energy input changes significantly for the European Union.

Concomitantly, the decarbonisation agenda accelerated in a year that experienced unprecedented weather changes. Inflation and interest rates spiked upward during the year while many non-Dollar currencies weakened. Beyond currencies, equities, commodities, cryptos and properties in certain areas saw unfavourable movements.

As the year ended, container shipping’s spot freight rates normalised downward rapidly, being attuned to lesser demand and much-abated supply chain constraints. China also removed its zero-Covid policy, facilitating the resumption of its manufacturing capacity for the global economies.

Against such a backdrop, Westports handled a container throughput of 10.05 million TEUs in 2022. The lower transhipment containers handled of 6.08 million TEUs is a part-reflection of the challenging global external conditions and the consequent container shipping companies’ operational and service adjustments.

Meanwhile, the domestic economy showed relatively better resilience as export-oriented sectors benefited from increased competitiveness with a weaker local currency. Specific sectors have benefited from regionalisation and Foreign Direct Investments as the latter capitalised on the nation’s competitive advantage. The gateway volume increased by 9% to 3.97 million TEUs, with notable growth during the 3rd and 4th Quarters of 2022.

It was a record-breaking year in the conventional segment; the Company moved 12.12 million metric tonnes of cargo. There was a notable increase in the liquid bulk category as the growth was supported by the new Liquid Bulk Terminal 5 (“LBT5”) jetty that can accommodate Very Large Gas Carriers (“VLGC”)

In 2022, the LBT5 facilitated the discharge and transfer of Liquefied Petroleum Gas (“LPG”) throughput into the landed-clients-operated specially-built facilities that cater to regional customers’ requirements. To capture further growth of non-bunker-fuel and liquid storage requirements, Westports will construct the Liquid Bulk Terminal 4A (“LBT 4A”); the latter is scheduled to be completed by the end of 2023.

On the Company’s profitability, Westports achieved a lower Profit Before Tax of RM944 million for 2022. The lower profit reflected the significantly higher fuel cost by 69%; Westports purchases diesel at an unsubsidised price; the absence of non-recurrent insurance recoveries; and higher human resources cost as the Company implemented the revised minimum wage earlier than required in January 2022.

At the bottom line, Westports reported a lower Profit After Tax of RM700 million, which was lower by 13% as the Company incorporated the one-year prosperity tax in 2022. With tax allowances arising from the Company’s investments, especially in new terminal trucks, Rubber Tyred Gantry cranes and Quay Cranes during the year under review, the Company’s effective tax rate was 26% for 2022.

The Company paid its first interim dividend amounting to RM236 million in August 2022. The second interim dividend of 7.46 sen per share, amounting to RM254 million, will be paid on 17 February 2023.

Datuk Ruben Emir Gnanalingam bin Abdullah (“Datuk Ruben”), the Group Managing Director of Westports, reviewed, “We have observed some tumultuous challenges in certain countries. We are thankful to the Malaysian Government and Rakyat’s support so that our nation has emerged relatively less adversely affected by challenging external conditions. At Westports, our commitment to enhancing the well-being of the lower-income group is reflected by the Company in ensuring that the higher minimum pay is implemented well before the required date once it has been announced publicly. This group also benefits from additional allowances and productivity-linked incentives. The Company’s CSR activities also focus on improving the living conditions of those lesser-endowed at Pulau Indah”.

“Despite these challenges and lower profitability for the year, Westports has declared that it is committed to achieving net-zero carbon emissions by 2050. We took delivery of the country’s first Kalmar Eco Reachstacker, commissioned into service new electric-powered Super Post- Panamax Quay Cranes with a twin-lift capacity of 55 tons, planted almost 500 additional trees within the terminal’s vicinity and some 550 additional mangrove trees in Pulau Indah”.

“Our commitment towards Pulau Indah community’s well-being, as reflected by our extensive CSR activities, and investments in mitigating our carbon footprint while improving our corporate governance, is recognised externally. Westports won two awards from The Edge Malaysia ESG Awards 2022 – the Gold Award in Most Consistent Performer Over 5 Years and another Gold Award in Transportation and Logistics category”.

Datuk Ruben concluded that “Sustainalytics, a leading independent ESG and corporate governance research, ratings and analytics firm, has evaluated that Westports operations sustained 16,100 jobs while contributing an annual GDP of RM1.6 billion to the local economy. We will continue to play our role as the leading gateway port for Malaysia and support her economic activities. To fulfil this objective even better in the coming years, the Company has planned to undertake and build the mega Container Terminal from CT10 onwards after reaching a new concession agreement with the Government. This is Westports’ financial commitment to improving the competitiveness of Port Klang in South East Asia also as a transhipment hub”.